.png?rev=b2c1cc4b45aa40e6a760344e6918daf6) Tim Morris

Tim Morris

Senior Vice President of Sales, Marketing and Customer Support - Americas

____

JLG Industries

JLG is excited about the future of the U.S. rental market. It has matured a lot in the past decade.

For example, rental companies have adopted sophisticated business models that enable them to meet customer expectations, optimize utilization and maximize return on their equipment investments.

Each day, they manage hundreds of transactions, including sales, invoicing, processing and delivery, most of which is booked after 2:00 p.m. for delivery the next business day.

They maintain hundreds of equipment brands with thousands of employees. The increasingly collaborative nature of these companies with manufacturers, along with advances in technology presents many opportunities moving forward.

Below are responses to some of the most frequently asked questions I get about the U.S. rental market today and JLG’s outlook for the coming year…

What is your current view of the U.S. rental market?

Rental demand in the U.S. is healthy following two years of pandemic-related business disruptions. Key tailwinds include pent-up post-pandemic demand, infrastructure spending and fleet replacement activity. Headwinds remain a constrained supply chain, inflation, logistics, the rising cost of fossil fuels and a competitive labor environment.

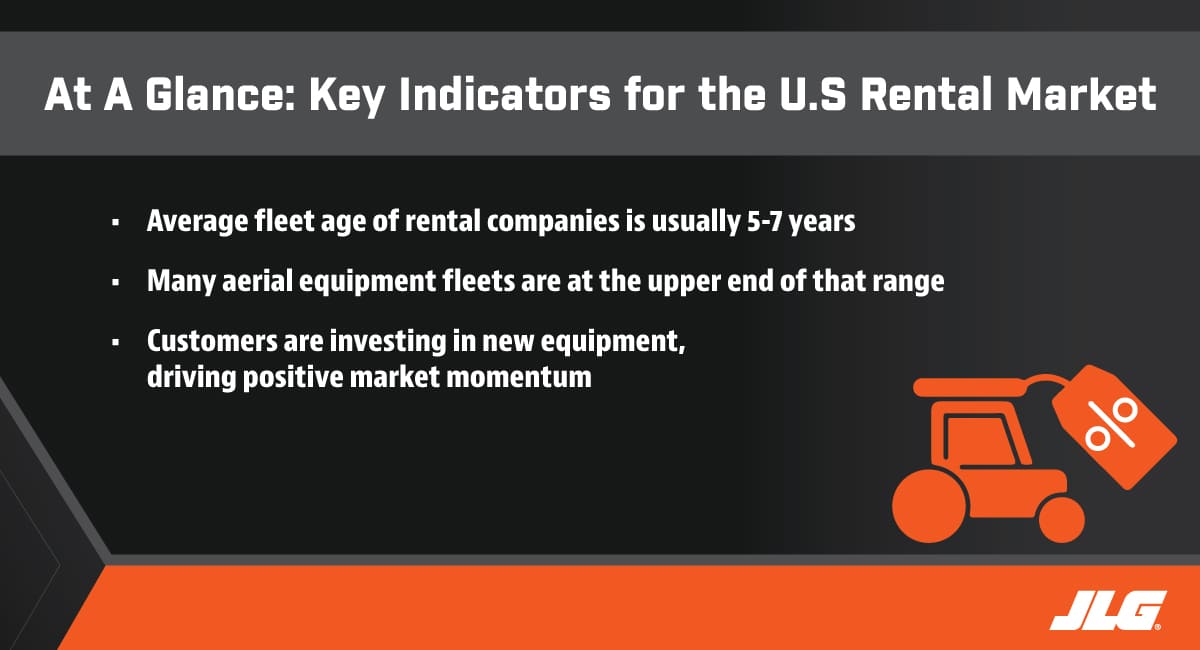

Key indicators suggest that the U.S. rental market will remain healthy as we move into 2023. One of the indicators JLG follows is the average fleet age of rental companies, which is usually 5-7 years. Right now, we know that many of our customers’ aerial equipment fleets are at the upper end of that range. Many are therefore investing in new equipment, which is driving positive market momentum.

How is the rental market is evolving at the moment?

Historically, the construction industry, including the rental market, has lagged in the adoption of technology. Today, however, we are seeing acceleration across the adoption curve. When the pandemic struck, the world quickly had to embrace new ways of working, many of which were facilitated through technology. As a result, the rental industry ecosystem is becoming more technologically astute. Many of the headwinds the industry is facing can be minimized through technology. For example, autonomous and semi-autonomous solutions and robotics can be used to offset the labor shortage and improve productivity.

From an OEM perspective, JLG continues to focus on and invest in delivering equipment and technology solutions that help solve job site challenges. We work to make JLG equipment “smarter” through advanced telematics and predictive analytics, and we work to make it safer by integrating active safety technologies.

Additionally, we are also investing in companies like Microvast to advance battery technologies and forging developmental partnerships with like-minded companies, such as Construction Robotics and RE2, to advance and accelerate the integration of robotics and autonomous features into JLG machines.

In terms of digital transformation across the rental industry, we have certainly seen improvement, however, we continue to look at adjacent industries, such as automotive, for cues on where future developmental opportunities may exist relative to technology.

Are rental customers asking for anything new?

Rental companies today are asking for their equipment suppliers, including JLG, to manufacture products that improve the efficiency, safety and productivity of their fleet.

At JLG, we believe in customer-inspired innovation and spend a great deal of time both with our rental customers and the users of our equipment to better understand what features and functions they would find most beneficial.

A recent example of this is the new JLG 670SJ self-leveling boom lift. Uneven ground conditions have long been a challenge for boom lift operators, so JLG focused on developing self-leveling technology that would allow an operator to traverse slopes up to 10 degrees and travel at full height in most situations. This self-leveling technology improves safety, while offering significant productivity benefits by eliminating the time and costs associated with cribbing and grading the work area.

How has the way rental business is conducted changed?

Rental companies have significantly changed the way they do business. They have become more open to a collaborative approach with suppliers. Today, manufacturers, rental companies and customers are working together to advance the industry. JLG’s Innovation Center in Hagerstown, Maryland, is a focal area for this type of collaboration. Here we ideate and develop concept machines and technologies, then gather valuable customer insights. When we collaborate in this manner, everyone wins.

In terms of rental demand, which products or product classes are performing well and why?

All product classes are in high demand right now because of the void created during the pandemic. As mentioned previously, aging rental fleets have created strong market demand for aerial equipment, including both MEWPs and telehandlers. We are also seeing rental companies expand their equipment offering to provide a wider range of products, including getting into new product categories, like low-level access, and diversifying within popular categories like telehandlers by adding rotating models to their mix. As a leading supplier of this type of equipment, we are working to offer products that meet the evolving needs of our customers.

How have supply chain issues affected the rental business?

Right now, an ongoing challenge we face as a manufacturer is the constrained supply chain. In certain categories, we are starting to see signs of stabilization as supply and demand begin to align. In other categories, like chips and engines, demand continues to outweigh supply.

For rental businesses, this has meant forecasting product needs and securing build slots from manufacturers earlier to get the equipment needed for their fleet.

How are factors such as economic stimulus affecting rental demand?

Rental demand is robust, and the economic stimulus certainly helps. A backlog of construction activity that was delayed during the heart of the pandemic combined with infrastructure spending is contributing to the overall health of the industry.

For a look at how today’s U.S. rental market has changed from 2020-2021, click here. To read more about the state of the rental industry, click here.

Do you want to stay up-to-date with industry news and issues similar to this? Make sure you subscribe below to receive monthly updates from #DirectAccess with newly posted content so you never miss important information.