When you’re looking to leverage new opportunities to grow your business, you need more than a plan — you need capital.

Of course, there’s the cash you have on hand. But those cash reserves are a precious commodity, especially if the pandemic has impacted your revenue. When it comes to enacting an expansion plan, upfront expenses can quickly outpace revenue.

Oftentimes, one of these upfront expenses is equipment. Below are insights from JLG Financials’ lending partner in the U.S., LEAF Commercial Capital, Inc. (LEAF), on financing for your business’s future growth…

The equipment your business depends on to help produce revenue requires a substantial financial investment in the earliest stages of your expansion plan. So, how do you develop a long-term plan to take advantage of new opportunities and scale your business with confidence?

More than likely, you haven’t considered that equipment financing can be a central tool for enacting your expansion plans. But it can.

Here’s how…

For Businesses with Revenue-Producing Equipment Connected to a Contract

If you deploy equipment that directly impacts your revenue, your ability to grow or reimagine your business is directly proportional to how much equipment you have working for you.

And how much profit you make depends on keeping your equipment costs affordable and predictable. There is no better way to preserve your cash, manage your cash flow and budget, and align your investment in equipment than to deploy an effective financing strategy.

This not only helps reduce the short-term pains of starting a new customer contract; it also helps reduce costs throughout the lifecycle of the asset.

For Companies Transforming Their Business Model

If you’re a company planning to transform your business model, it can take months to build up your brand, and the revenues might only trickle in for a while before the anticipated flood.

Still, upfront costs wait for no one and can have a damaging impact on cash reserves unless you’ve built an equipment financing strategy from the outset.

By working with a lender who understands the entire situation, you might be able to establish a “step-up” structure with minimum payments due for the first few months while you’re building up your new customer base. This structure is just one of the possible equipment financing structures that help business owners manage cash flow, conserve cash, and preserve credit lines before new revenues are realized.

A Model for the Future

In the final analysis, using equipment finance as a proactive tool is more than making your current situation more affordable. It’s a model you can use to enter into new growth opportunities with confidence.

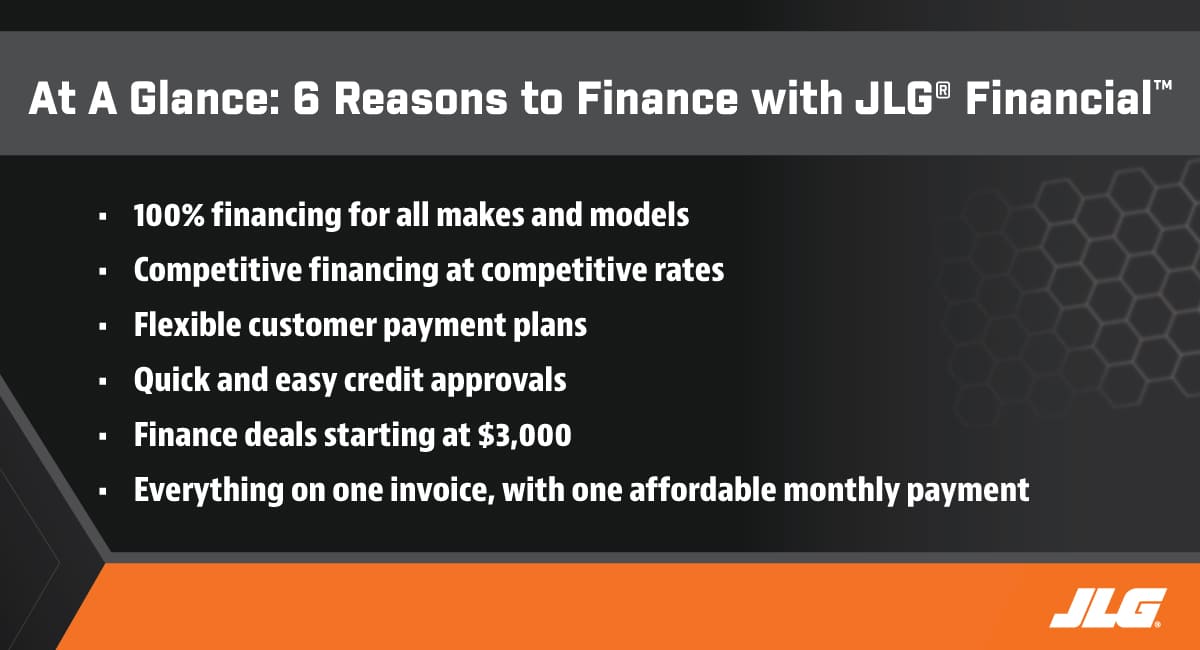

To discover how equipment financing structures from JLG Financial can help you expand your business, click here.

Do you want to stay up to date with industry news and issues similar to this? Make sure you subscribe below to receive monthly updates from Direct Access with newly posted content so you never miss important information.