JLG Industries, Inc.

JLG Industries, Inc.

World-leading access equipment manufacturer

____

McConnellsburg, PA

Decades ago, when your business made a large equipment purchase, the cost was probably written off over time through a standard depreciation schedule. Eventually, over a few years, the business would write off 100% of the acquisition cost of the equipment.

Then came the great recession of 2008, spurring the U.S. government to look for new ways to stimulate the economy and encourage businesses to invest in themselves. That’s when Section 179 of the tax code, something that existed for decades prior, started to see some major changes.

Another change that came with the tax code in 2008 was the addition of “bonus first year depreciation” for qualifying purchases. This is something that is typically utilized after the Section 179 deduction limit is reached and has historically only applied to new equipment.

Today, chances are if you own and operate a business, especially one in the construction or access industry, you’re familiar with Section 179 and bonus depreciation. Both of these tax incentives were created as a way to encourage small and medium size businesses to purchase high-ticket items and write off their entire acquisition cost in the first year of use. This could be anything from boom lifts and telehandlers to scissor and vertical lifts or updated business software. Simply put, Section 179, along with potential bonus depreciation, can increase the purchasing power of your business by eliminating the need to wait several years to take advantage of tax savings.

What’s changed since then?

Even if you’re familiar with Section 179 and bonus depreciation, in January of 2018, with the passage of the Tax Cuts and Jobs Act (TCJA), some major changes to the limits and type of equipment that qualified for bonus depreciation were introduced. There are two major changes you should be aware of:

1. 100% Bonus Depreciation

In 2018, bonus depreciation increased to 100% and will remain at that level for five years (at which time it will phase out over the next several years).

2. New vs Used Equipment

Perhaps the most important difference for tax payers and businesses who purchase aerial equipment, is that in 2018 both new and used equipment qualify for bonus depreciation (as long as the used equipment is “new to you”). Leased equipment is eligible as well.

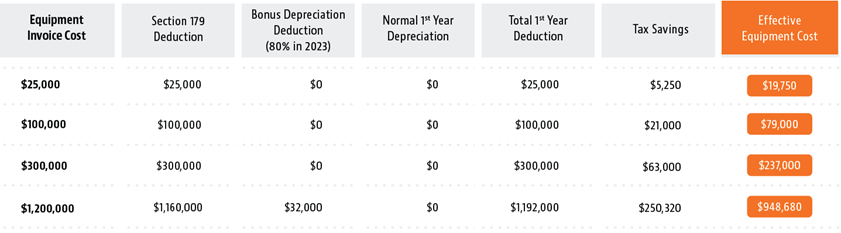

The chart below illustrates the tax savings potential when combining Section 179 and bonus depreciation.

If you’re considering an equipment purchase by the end of year, you may have several questions when it comes to Section 179 and bonus depreciation. Below are a few common questions (and answers).

1. What equipment qualifies for the Section 179 deduction?

Here are some examples of equipment that may qualify for Section 179:

- Equipment (machines like scissor lifts, boom lifts, etc.) purchased for business use

- Tangible personal property used in business

- Business Vehicles with a gross vehicle weight in excess of 6,000 lbs (see Section 179 Vehicle Deductions)

- Computers

- Computer “Off-the-Shelf” Software

- Office Furniture

- Office Equipment

2. Does only new equipment qualify for the deduction?

No, used equipment also qualifies for the Section 179 deduction so long as it is “new to you”.

3. Is there a spending limit for the Section 179 deduction?

Section 179 does come with limits – there are caps to the total amount written off ($1,080,000 for 2022), and limits to the total amount of the equipment purchased ($2,700,000 in 2022). The deduction begins to phase out on a dollar-for-dollar basis after $2,700,000 is spent by a given business, so this makes Section 179 well-suited for small and medium-sized businesses.

4. What is bonus depreciation?

First, bonus depreciation isn’t something that’s offered each year. Since the changes in 2018 though, it’s being offered at 100%. The most important difference is both new and used equipment qualify for the Section 179 Deduction (as long as the used equipment is “new to you”), while Bonus Depreciation has only covered new equipment until the most recent tax law passed. In a switch from recent years, the bonus depreciation now includes used equipment.

5. When is the deadline to apply for Section 179 and potential bonus depreciation?

To apply the deduction for the 2022 tax year, equipment must be financed, leased or purchased between January 1, 2022 and December 31, 2022. The eligible equipment must also be put into service (delivered to your company and ready to work) before midnight on December 31, 2022 to be eligible. Remember, prior equipment purchases made throughout the year may already have used the deduction to its full potential.

There’s a lot to consider to determine if your business would benefit from a Section 179 and/or a bonus depreciation deduction. Before making a final decision, be sure to check with a local accountant or tax consultant to determine if it’s in your best interest to utilize either incentive.

Want to stay up to date with industry news and trends similar to this? Make sure you subscribe below to receive monthly updates from Direct Access with newly posted content so you never miss important information.

*Sources:

https://www.irs.gov/newsroom/new-rules-and-limitations-for-depreciation-and-expensing-under-the-tax-cuts-and-jobs-act

https://www.section179.org

The information on this page should not be construed as tax advice or as a promise of potential tax savings or reduced tax liability. Please contact your accountant or tax consultant/attorney to see how Section 179 and bonus depreciation would apply to your individual business.